About the Charleston O Fund LP

The Charleston O Fund, LP is a Qualified Opportunity Fund. It offers investors a new tax advantaged investment strategy.

The fund model enables investors to pool their resources in Opportunity Zones, increasing the scale of capital going to investments selected by Sanctuary Investment Groups professionals. The Fund allows individuals to invest in private real estate opportunities in both commercial and residential markets in the Low Country of Charleston South Carolina designated opportunity zones. We have established a team of the best investment professionals, focused on real estate developments and growth equity investments. Above all, 90% or more of all of our Qualified Opportunity Zone Fund Investments go back into our communities across Charleston while potentially generating substantial returns for investors.

Target Market

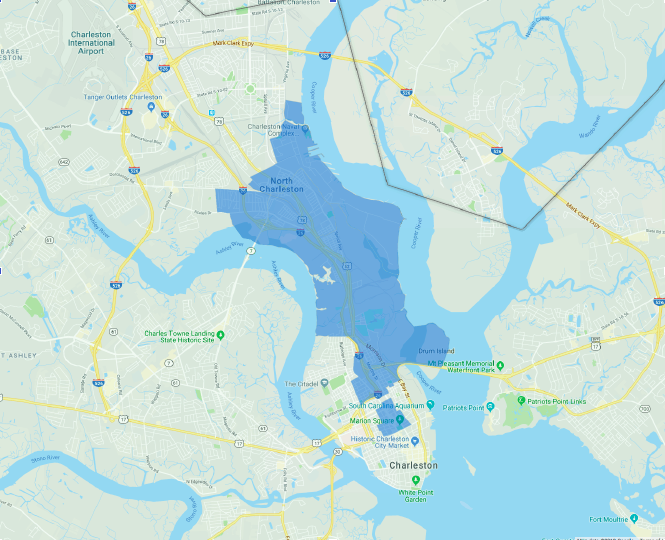

Real Estate investments in downtown Charleston, South Carolina and other low country opportunity zones

The Charleston O Fund LP will focus on middle market commercial and residential opportunity zone investments in the Charleston, SC area. Charleston has been voted the number 1 city in the world and for 6 straight years the number 1 city in the US by Travel + Leisure. It is now home to major corporations like Blackbaud, Boeing, Volvo and Mercedes. Downtown Charleston is home to College of Charleston and Medical University of South Carolina making both rental property and business investments more stable. Thriving tourism, industrial growth and top notch higher education institutions make the low country of Charleston one of the best real estate investments in the country.

Investment Overview

- Objective: We specifically enable you the opportunity to defer realized capital gains from stocks, real estate, art, etc., reduce those gains by up to 15% if held for 7 years and potentially eliminate all future capital gains on investments made in the Charleston O Fund. The Fund seeks to replace a portion of your traditional S&P 500/ fixed income portfolio while we preserve and increase the purchasing power value of its shares over the long term.

- Strategy: Designed as a core portfolio holding, this fund seeks to preserve and increase the purchasing power value over the long-term, regardless of current or future market conditions, through strategic investments in a broad array of diversified and non-correlated real estate assets and businesses within various opportunity zones, primarily in Charleston, SC.

- Time Horizon: 10 years. This is a long term investment for those that will not need access to the funds.

- We are currently offering the opportunity to invest in the fund. The minimum investment is $100,000. On a case by case basis we can approve smaller amounts.

Charleston O Fund LP

- Type of Fund: Stock (Class B 1:1 Common)

- Asset Classification: Multiple Projects

- Total Fund Size Authorized: $50M

- Total Fund Stock Available: $50M

- Total Fund Stock Round A: $50M

- Amount of Fund Spent: $0

- Current Fund Equity: +$200K

- Current Total Investments: NEW

- Active Potential Investments: 3

- Minimum Investment: $100,000

“This is a historic opportunity that seldom presents itself. It is a unique chance for investors to receive significant tax savings while investing in real estate located in Charleston, SC and other sections of the Low Country, that Sanctuary Investment Group has identified as exhibiting strong growth potential. It is a chance to make a difference in the communities we hold dear and at the same time, utilize the tax code to create generational wealth. It is also a chance for our investors to further diversify out of traditional investments such as stocks and bonds and into real estate, while also earning the additional return boost due to the tax savings of the Opportunity Zones program”.

—John J Coppola, Founder of Sanctuary Opportunity Funds

Sanctuary Investment Group LLC

General Partner

Sanctuary Investment Group LLC, was born out of The Federal Tax Cuts and Jobs Act of 2017, where Congress established the Opportunity Zone program designed to spur economic development and job creation in distressed communities through significant tax benefits to investors. It was founded on the belief that investors deserve a safe, simplified, managed approach to real estate investment giving them the confidence and ability to diversify their investment portfolio away from the traditional stock market. When you partner with Sanctuary, we are aligning ourselves with you by investing our capital side by side. We are committed to working diligently to deliver your investment returns while safeguarding your capital in a way that is unique and new. By partnering with us, you will be utilizing our industry and tax law knowledge to make educated and empowered investment decisions.

Executive Team

John J Coppola

Cheif Executive Officer

A 25 year veteran in the investment management arena, John’s mission has been safeguarding investors precious assets while working with them to ensure that the investments of the firm align with their long term financial goals. Before founding Sanctuary Opportunity Investment Group LLC, he has managed investors assets while being a registered investment advisor, a senior portfolio manager for a privately held Investment company and as Vice President at Merrill Lynch. John graduated from the University of Michigan.

Disclaimers

Investing in the Fund involves risks, including the risk that you may receive little or no return on your investment or that you may lose part or all of your investment. The ability of the Fund to achieve its investment objective depends, in part, on the ability of the Advisor to allocate effectively the Fund’s assets in which it invests. There can be no assurance that the actual allocations will be effective in achieving the Fund’s investment objective or delivering positive returns.

The Fund’s investments may be negatively affected by the broad investment environment in the real estate market, the debt market and/or the equity securities market. The value of the Fund’s investments will increase or decrease based on changes in the prices of the investments it holds. This will cause the value of the Fund’s shares to increase or decrease. The Fund is “non-diversified” under the Investment Company Act of 1940 since changes in the financial condition or market value of a single issuer may cause a greater fluctuation in the Fund’s net asset value than in a “diversified” fund. The Fund is not intended to be a complete investment program.

Limited liquidity is provided to shareholders only through the Fund’s quarterly repurchase offers for no less than 5% of the Fund’s shares outstanding at net asset value. There is no guarantee that shareholders will be able to sell all of the shares they desire in a quarterly repurchase offer. Quarterly repurchases by the Fund of its shares typically will be funded from available cash or sales of portfolio securities. The sale of securities to fund repurchases could reduce the market price of those securities, which in turn would reduce the Fund’s net asset value.

Investing in the Fund’s shares involves substantial risks, including the risks set forth in the “Risk Factors” section of this prospectus, which include, but are not limited to the following: the Fund may invest in convertible securities which are subject to risks associated with both debt securities and equity securities; correlation risk such as in down markets when the prices of securities and asset classes can also fall in tandem; credit risk related to the securities held by the Fund which may be lowered if an issuer’s financial condition changes which could negatively impact the Fund’s returns on investment in such securities; interest rate risk including a rise in interest rates which could negatively impact the value of fixed income securities.

The Fund’s investment in Institutional Investment Funds will require it to bear a pro rata share of the vehicles’ expenses, including management and performance fees; Issuer and non-diversification risk including the value of an issuer’s securities that are held in the Fund’s portfolio may decline for a number of reasons which directly relate to the issue and as a non-diversified fund.

The Fund may invest more than 5% of its total assets in the securities of one or more issuers; lack of control over institutional private investment funds and other portfolio investments; leverage risk which could cause the Fund to incur additional expenses and may significantly magnify the Fund’s losses in the event of adverse performance of the Fund’s underlying investments; management risk including the judgments of the Advisor or Sub-Advisor about the attractiveness, value and potential appreciation of particular real estate segment and securities in which the Fund invests may prove to be incorrect and may not produce the desired results; market risk; a risk that the amount of capital actually raised by the Fund through the offering of its shares may be insufficient to achieve profitability or allow the Fund to realize its investment objectives; option writing risk; possible competition between underlying funds and between the fund and the underlying funds; preferred securities risk which are subject to credit risk and interest rate risk.

The Fund will concentrate its investments in real estate and, as such, its portfolio will be significantly impacted by the performance of the real estate market; real estate development issues; insurance risk including certain of the companies in the Fund’s portfolio may fail to carry adequate insurance; dependence on tenants to pay rent; companies in the real estate industry in which the Fund may invest may be highly leveraged and financial covenants may affect their ability to operate effectively; environmental issues; current conditions including recent instability in the United States, European and other credit markets; REIT risk including the value of investments in REIT shares may decline because of adverse developments affecting the real estate industry and real property values; underlying funds risk, use of leverage by underlying funds; and valuation of Institutional Investment Funds as of a specific date may vary from the actual sale price that may be obtained if such Investments were sold to a third party.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Total Income+ Real Estate Fund.