About Us

Sanctuary Opportunity Funds

Sanctuary Opportunity Funds is a private equity firm specializing in Qualified Opportunity Zone Investments in the low country of South Carolina. We offer accredited investors, family offices and other institutions a new tax-advantaged investment strategy that will further diversify one’s investment portfolio out of traditional investments, such as stocks and bonds, and into Real World Assets like real estate and Fine Art, combined with the additional return boost due to the tax savings of the Opportunity Zones program when possible. Unlike many larger fund companies, we are local, readily accessible to our investors and welcome investor input on potential projects. We are looking for partners, not just investors to help navigate this newly created investment landscape.

Available Investment Opportunities

-

JMB Fine Art Fund LP

Discover a revolutionary opportunity and a rare chance to own a part of history! Introducing a once in a lifetime opportunity to invest in an important part of art history. Our curated JMB Fine Art Fund LP is comprised of over a hundred masterpieces by Jean-Michel Basquiat. Participants in this investment vehicle will be part of a revolutionary program that offers exclusivity, diversity and scale, immediately accretive to your bottom line. For investors looking to take advantage of the tax advantages of Opportunity Funds, contact us today to learn how!

Learn More

-

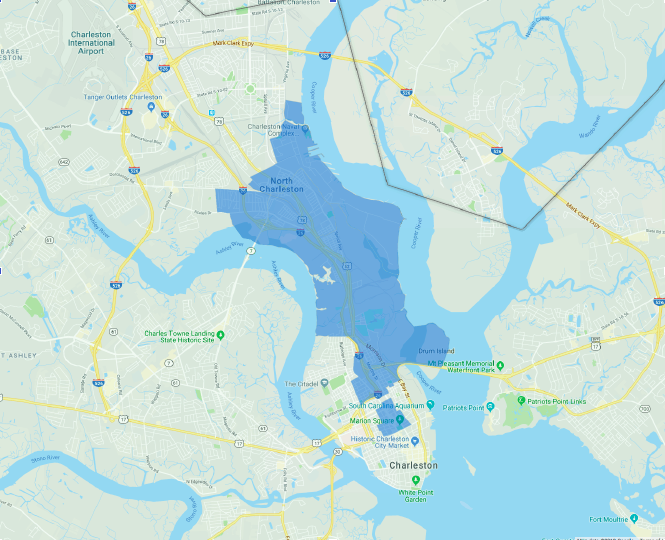

Charleston O Fund LP

The Charleston O Fund LP is a Qualified Opportunity Fund. Complying with the new “Opportunity Zones” section of the Tax Cuts and Jobs Act of 2017, the Fund will invest directly into a diversified portfolio of assets in qualifying opportunity zones within Charleston, SC allowing investors to take advantage of preferential tax treatment. The fund model enables investors to pool their resources in Opportunity Zones, increasing the scale and diversity of capital going to investments selected by Sanctuary Investment Group LLC investment committee. The Fund allows individuals to invest in private real estate opportunities in both commercial and residential markets as well as opportunity zone businesses located in the Low Country of Charleston South Carolina designated opportunity zones.

Learn More

-

Philanthropic Opportunity Fund, LP

The Philanthropic Opportunity Fund, LP is a Qualified Opportunity Fund that is designed to promote economic vitality to low income communities across the country that have not shared in the general economic prosperity over the past decade. In lieu of your normal donation to a charity that makes questionable investments for which you only receive a tax write off, our mandate is clear and all the contributions will go directly towards those areas within opportunity zones and after 10 years be returned to your organizations so you can redistribute your funds how you see fit.

Learn More

About Opportunity Funds

What is an Opportunity Fund?

An Opportunity Fund is a new investment vehicle created as part of the Tax Cuts and Jobs Act of 2017 to incentivize investment in targeted communities called OpportunityZones. Opportunity Funds are investment vehicles that invest at least 90% of their capital in Qualified Opportunity Zones. To capture the potential tax benefits offered by an Opportunity Fund, an investor must invest the gains from a sale of a prior investment (e.g., stock, bonds, real estate, a company) into an Opportunity Fund within 180 days of the sale of that investment. The investor only has to roll in the gain or profits from the sale of the investment, not the original principal of the investment. Moreover, only the taxable gains rolled over into an Opportunity Fund are eligible to receive the tax incentives.

Learn MoreHow they Work

How does Opportunity Fund Investing Work?

An investor who has triggered a capital gain by selling an asset like stocks or real estate can receive special tax benefits if they roll that gain into an opportunity fund within 180 days. There are three primary advantages to rolling over a capital gain into an opportunity fund:

-

Defer

The payment of Your capital Gains until dec 31, 2026.

-

Reduce

The tax you owe by Up to 15% after 7 Years.

-

Pay Zero

Tax on gains earned from the opportunity fund after 10 years.